Ondo Finance serves as a link between blockchain technology and conventional finance. There is still much potential for growth, as it is now 63% below its peak. Since releasing its initial products on Ethereum in early 2023, this platform has grown to become a major player in the DeFi ecosystem, with a market capitalisation of A$3.89 billion and over $400 million in total value locked.

Furthermore, Ondo Finance has recently partnered with Mastercard to link real-world assets to the blockchain via the Mastercard Multi-Token Network. This collaboration will make Ondo’s Short-Term US Government Treasuries Fund the first tokenised real-world asset integrated into this system. For investors wondering what Ondo Finance is, it essentially functions as a platform designed to make DeFi yields accessible to a broader audience with varying risk appetites.

Concerns regarding the Ondo Finance price forecast for 2025 and whether it is a wise investment become more pertinent as analysts estimate that the asset tokenisation market might reach $15 trillion by the end of the decade. This guide examines everything you need to know about Ondo Finance to make informed investment decisions in 2025.

What is Ondo Finance?

Founded in 2021 by a team of finance and technology experts, including Nathan Allman, a former Goldman Sachs professional, Ondo Finance has emerged as a revolutionary platform in the decentralised finance ecosystem. Unlike many crypto projects that aim to disrupt traditional finance, Ondo takes a different approach.

A Bridge Between Traditional Finance and DeFi

Ondo Finance serves as a crucial link between conventional financial markets and blockchain technology. The platform specialises in creating structured financial products that combine elements from both worlds. From traditional finance, Ondo incorporates risk management frameworks, structured products, and fixed-income approaches. Meanwhile, DeFi leverages blockchain transparency, smart contract automation, and accessibility for all investors. This hybrid approach creates blockchain-based financial services that feel familiar to traditional investors while maintaining the innovative aspects that attract crypto enthusiasts.

Ondo and Real-world Assets

At its core, Ondo Finance focuses on tokenising real-world assets (RWAs), particularly US Treasury bonds. This process transforms traditionally illiquid financial instruments into blockchain-based tokens that can be traded or used in DeFi applications. The platform’s flagship offerings include OUSG, a token backed by short-term US Treasury bills, and USDY, a yield-bearing stablecoin backed by Treasuries and bank deposits. These products allow crypto investors to gain exposure to one of the safest traditional investments without leaving the blockchain ecosystem. The tokenised Treasury market experienced rapid growth in Q1/2025, demonstrating increasing institutional demand for compliant, yield-generating digital assets.

The 2025 DeFi Landscape

In the current DeFi landscape, Ondo Finance has positioned itself as a leader in the rapidly growing RWA space. A recent report by BCG estimates that A$24.46 trillion in assets will come on-chain in the next decade. Ondo is well-positioned to capture this value, currently holding approximately 40% market share in tokenised securities with over A$344.02 million in assets under management. Additionally, Ondo has developed Ondo Chain, a public, proof-of-stake Layer 1 blockchain designed explicitly for institutional-grade real-world assets. This innovation combines the best of public and permissioned chains, providing features that institutions require while maintaining open access for users.

What products Does Ondo Finance Offer?

Ondo Finance’s product suite has expanded substantially since 2023, offering innovative solutions that sit at the intersection of traditional finance and blockchain technology. Each product addresses specific needs in the evolving DeFi landscape.

USDY

Unlike traditional stablecoins, USDY functions as a tokenised secured note backed by short-term US Treasuries and bank deposits. It generates yield through increasing redemption value, currently providing approximately 5.2% APY to holders. The token requires a strict KYC process and operates with a unique issuance timeline—users must wait 40-50 days before their tokens become transferable. Notably, USDY offers bankruptcy-remote protection through its structure, with Ankura Trust serving as both Verification Agent and Collateral Agent to enforce eligibility criteria and protect holder interests.

OUSG

OUSG provides exposure to short-term US Treasuries with 24/7 instant minting and redemption capabilities. The fund currently offers 4.09% APY with management fees capped at 0.15% (waived until October 2025). OUSG comes in two versions: an accumulating token where yield appears as an increasing share price, and rOUSG. This rebasing token maintains a stable value while distributing yield through additional tokens. The fund primarily invests in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and other high-quality assets, with a total value of underlying assets reaching over AUD 1 billion.

Flux Finance

Initially developed by Ondo Finance (later sold to Neptune Foundation), Flux Finance functions as an on-chain Treasury repo marketplace. This protocol is a fork of Compound V2 with additional functionality supporting both permissionless tokens (like USDC) and permissioned tokens (such as OUSG). It enables overcollateralised lending and borrowing in a peer-to-pool model, where users can earn interest by supplying stablecoins or borrow against deposited collateral. Permissions are enforced on a per-asset basis, meaning USDC lenders face no restrictions, but borrowers using OUSG as collateral must meet specific permissions.

Ondo Bridge and Converter Tools

The Ondo Bridge facilitates cross-chain transfers of Ondo’s tokenised assets. Rather than locking tokens on the source chain, the bridge burns tokens and mints new ones on the destination chain, preventing potential losses from bridge hacks. Currently, it supports USDY transfers between Ethereum and Mantle networks. The Ondo Converter allows seamless switching between OUSG versions (accumulating and rebasing) without slippage, giving users flexibility in how they receive and manage yield.

Understanding the ONDO Token

The ONDO token forms the backbone of Ondo Finance’s ecosystem, serving multiple purposes beyond mere investment value. As the platform continues to evolve in 2025, understanding ONDO’s functionality becomes increasingly essential for potential investors.

Governance and DAO Participation

The ONDO token functions as the primary governance instrument for the Ondo DAO, granting holders authority to shape the platform’s future. Through this decentralised structure, token holders can vote on critical protocol upgrades, economic parameters, and smart contract modifications. The governance process typically follows a two-stage approach: beginning with discussions on the Flux Finance Governance Forum and followed by binding on-chain votes.

For those interested in active participation, the governance mechanism operates with specific parameters: a proposal threshold of 100,000,000 ONDO tokens to prevent spam, a 3-day voting period, a minimum quorum of 1,000,000 ONDO, and a 1-day timelock before implementation. Interestingly, even locked tokens retain voting rights, ensuring broad participation in decision-making.

Token Supply and Vesting Schedule

ONDO has a fixed supply of 10 billion tokens with no planned inflation. Currently, approximately 31.59% of tokens are in circulation, with the remainder locked in various allocation pools. The token distribution is structured as follows:

- Ecosystem Growth: 52.1% (5.21 billion tokens)

- Protocol Development: 33% (3.3 billion tokens)

- Private Sales: 12.9% (1.29 billion tokens)

- Community Access Sale: 2% (198.88 million tokens)

The vesting schedule follows a thoughtful, long-term approach. Core team members are subject to a 5-year lock-up period, demonstrating commitment to the project’s future. Moreover, the next significant token unlock is scheduled for January 2026, when 19.4% of the total supply will be released.

ONDO Token Use Cases

Beyond governance, ONDO serves multiple practical functions within the ecosystem. On the Ondo Chain, a permissioned layer-1 blockchain designed for institutions, ONDO is used for transaction fees and facilitating real-world asset tokenisation.

Consequently, token holders can stake ONDO to earn yield, creating passive income opportunities. For institutional investors, the token enables the staking of tokenised real-world assets and supports sophisticated financial strategies like future yield trading. As Ondo Finance continues expanding its real-world asset offerings, the utility and demand for ONDO tokens may increase correspondingly.

Ondo Finance Price and Market Performance

As of July 2025, Ondo Finance has established itself as a significant player in the tokenised real-world assets market. Let’s explore its market position and potential future trajectory.

ONDO Price and Market Cap

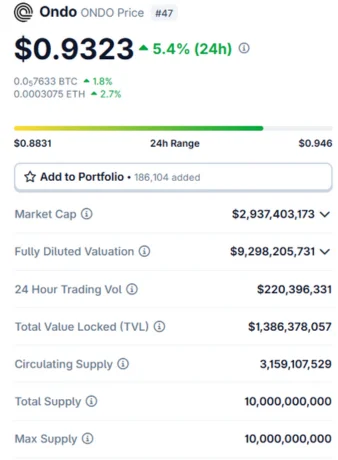

Presently, the ONDO token trades at AUD 1.23, showing a 3.24% increase over the last 24 hours. With a circulating supply of approximately 3.16 billion tokens, Ondo Finance boasts a market capitalisation of AUD 3.89 billion. This places the project at #38 in global cryptocurrency rankings. The token’s 24-hour trading volume stands at approximately AUD 130.9 million, representing 3.36% of its total market cap. Despite having a total supply of 10 billion tokens, only about 31.5% are currently in circulation.

Historical Price Trends and All-Time High

Ondo reached its all-time high of AUD 3.27 on December 16, 2024, approximately seven months ago. Currently, the token trades at 62.43% below this peak. Conversely, Ondo hit its all-time low of AUD 0.13 in January 2024, representing an impressive 862.82% increase from that point. Throughout the first half of 2025, ONDO has displayed considerable volatility, with June and early July showing a pattern of price fluctuations between AUD 0.62 and AUD 0.92.

Ondo Finance Price Prediction 2025

According to various forecasts, Ondo Finance shows promising growth potential for the remainder of 2025. Indeed, the most optimistic predictions suggest ONDO could reach between AUD 2.35 and AUD 2.83 by year-end. Throughout, analysts emphasise the token’s connection to real-world assets as a key driver of value. Nevertheless, alternative analyses suggest a more conservative outlook, with some models predicting a potential trading range between AUD 0.84 and AUD 1.22.

Is Ondo Finance a Good Investment?

Overall, Ondo Finance presents a compelling investment case due to its strong focus on tokenised real-world assets. The platform’s robust partnerships and institutional backing indicate significant growth potential. Albeit volatility remains a concern, the token has shown remarkable resilience, currently trading 878.76% above its all-time low. For investors considering Ondo, its innovative approach to bridging traditional finance with blockchain technology provides a unique value proposition. The current sentiment toward ONDO is generally neutral to positive according to technical analyses, suggesting cautious optimism about its future performance.

Conclusion – Ondo Finance

Ondo Finance stands at the forefront of real-world asset tokenisation, effectively bridging the gap between traditional finance and blockchain technology. Throughout 2025, the platform has demonstrated significant potential with its market capitalisation of A$3.89 billion and innovative product suite. Notably, USDY and OUSG offer unique alternatives to conventional stablecoins, while Flux Finance provides essential lending capabilities within the ecosystem.

The ONDO token certainly plays a crucial role beyond simple investment value, enabling governance participation and offering various utilities across the Ondo Chain. Despite currently trading 62.43% below its all-time high, the token has shown remarkable resilience, climbing 862.82% from its all-time low.

Looking ahead, the platform’s focus on tokenised real-world assets positions it advantageously within the growing DeFi landscape. Additionally, strategic partnerships with established entities like Mastercard strengthen Ondo’s credibility and growth prospects. The asset tokenisation market could reach A$15 trillion by the end of the decade, therefore creating substantial opportunities for Ondo to expand its market share.

Investors considering Ondo Finance should carefully weigh its innovative approach against market volatility factors. Still, the platform’s strong institutional backing and unique value proposition make it a noteworthy consideration for those seeking exposure to the intersection of traditional finance and blockchain technology. As real-world assets continue moving on-chain, Ondo Finance appears well-positioned to remain a significant player in this evolving financial ecosystem.

What is Ondo Finance, and how does it bridge traditional finance with DeFi?

Ondo Finance is a platform that connects traditional finance and blockchain technology by tokenising real-world assets, particularly US Treasury bonds. It offers products like USDY and OUSG, allowing crypto investors to gain exposure to traditional investments within the blockchain ecosystem.

What are the main products offered by Ondo Finance?

Ondo Finance’s core products include USDY, a yield-generating stablecoin alternative backed by short-term US Treasuries and bank deposits, and OUSG, which provides institutional access to tokenised Treasuries. They also offer Flux Finance, a lending protocol for stablecoins, and Ondo Bridge and Converter tools for cross-chain transfers and token conversions.

How does the ONDO token function within the Ondo Finance ecosystem?

The ONDO token serves as the primary governance instrument for the Ondo DAO, allowing holders to vote on protocol upgrades and economic parameters. It’s also used for transaction fees on the Ondo Chain and can be staked to earn yield. There is no anticipated inflation and the token has a 10 billion supply.

What is Ondo Finance’s current market performance?

As of July 2025, Ondo Finance has a market capitalisation of AUD 3.89 billion, ranking #38 in global cryptocurrency rankings. The ONDO token is trading at AUD 1.23, which is 62.43% below its all-time high of AUD 3.27 reached in December 2024.

What are the growth prospects for Ondo Finance in the coming years?

Due to its focus on tokenised real-world assets, Ondo Finance shows promising growth potential. Some predictions suggest ONDO could reach between AUD 2.35 and AUD 2.83 by the end of 2025. The platform’s partnerships, institutional backing, and unique approach to bridging traditional finance with blockchain technology contribute to its positive outlook in the evolving DeFi landscape.