Melbourne has long been regarded as one of Australia’s premier cities for property investment. Despite facing some turbulence in recent years, including interest rate hikes and economic uncertainties, the Melbourne property market is showing signs of recovery. Recent data indicates that property prices are beginning to stabilise, with a notable increase in buyer confidence as interest rates are projected to decline.

Price Trends

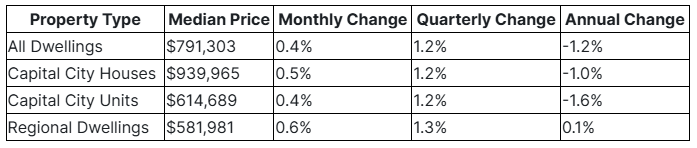

As of early 2025, the median price for all dwellings in Melbourne stands at approximately $791,303. While this figure reflects a slight decrease compared to previous peaks, it also highlights the potential for growth as the market rebounds. Notably, the average price of standalone houses in Melbourne is currently more affordable compared to Sydney, presenting a unique opportunity for investors seeking value.

Factors Influencing the Market

Several factors are currently influencing the Melbourne property market:

- Population Growth: Melbourne’s population continues to rise, driven by both international migration and interstate relocations. This influx of residents is creating increased demand for housing, particularly in family-friendly suburbs.

- Infrastructure Development: Significant investments in infrastructure, including transport and public amenities, are enhancing the appeal of various suburbs, making them more attractive to potential buyers and renters.

Economic Recovery Post-Pandemic

The aftermath of the pandemic has left a mark on the Melbourne property market, but recovery is underway. With interest rates stabilising and economic activity picking up, buyer confidence is gradually returning. This resurgence is crucial, as it lays the groundwork for a more robust property market.

- Interest Rates: After a period of hikes, rates are expected to level off, making borrowing more accessible for potential homeowners and investors.

- Economic Growth: The Victorian economy is showing signs of recovery, with increased infrastructure spending and job creation contributing to a more favourable environment for property investment.

Population Growth and Migration Trends

The Melbourne real estate market has long been a magnet for both domestic and international migrants. This trend is expected to continue, further fuelling demand for housing.

- Population Surge: The city’s population is projected to grow significantly, with estimates suggesting an increase of over 183,000 people in the next year alone.

- Migration Patterns: Both interstate and overseas migration are on the rise, with many seeking the lifestyle and opportunities that the Melbourne real estate market offers.

Investment Opportunities in 2025

Identifying High-Growth Suburbs

Not all areas of Melbourne will experience the same level of growth. Savvy investors should focus on suburbs that exhibit strong fundamentals and potential for capital appreciation.

- Inner and Middle Ring Suburbs: Areas with owner-occupier appeal and limited supply are likely to see the most significant price increases. Suburbs such as Glen Waverley and Mount Waverley are already showing promising signs.

- Gentrifying Areas: Suburbs undergoing revitalisation, like Preston and Reservoir, are attracting young families and professionals, making them prime targets for investment.

Discover the 10 Richest Suburbs in Melbourne: Property Prices & Luxury Living.

Property Types to Consider

When investing in the Melbourne property market, the type of property you choose can significantly impact your returns.

- Family Homes: Properties with three to four bedrooms in family-friendly suburbs are in high demand. These homes offer capital growth and steady rental income.

- Townhouses and Villa Units: As affordability becomes a concern, townhouses are increasingly popular among young families. They offer a balance between space and cost, making them an attractive option for both buyers and renters.

Challenges Facing the Market

Supply Constraints

Despite the growing demand, the Melbourne property market is grappling with supply issues. The number of new housing approvals is at a record low, which could lead to further price increases.

- Construction Slowdown: The number of dwellings under construction has decreased, particularly in high-density developments. The current housing shortage is probably going to get worse as a result of this tendency.

- Rising Costs: Increased construction costs and regulatory hurdles are making it more challenging for developers to bring new projects to market.

Regulatory Environment

The Victorian government has introduced several reforms that could impact property investors.

- Increased Taxes: Recent changes in land tax and rental regulations have raised concerns among investors. These measures may deter some from entering the market, but they also create opportunities for those willing to adapt.

- Tenancy Laws: Stricter tenancy laws have shifted the balance in favour of tenants, making it essential for landlords to stay informed and compliant.

The Future of the Melbourne Property Market

Long-Term Growth Potential

Despite the challenges, the long-term outlook for the Melbourne property market remains positive. The combination of strong population growth, economic recovery, and limited supply suggests that property values will continue to rise.

- Historical Performance: Over the past four decades, Melbourne has consistently been one of Australia’s top-performing property markets. While recent years have seen fluctuations, the fundamentals remain strong.

- Market Cycles: Property markets operate in cycles, and the Melbourne property market is currently at a turning point. Those who invest strategically now may reap significant rewards as the market gains momentum.

Key Trends to Watch

- Rental Market Dynamics: With vacancy rates at historic lows, the Melbourne real estate market is becoming increasingly competitive. This trend is expected to continue, driving rental prices higher and making investment properties more lucrative.

- Government Initiatives: The Victorian government is implementing policies to encourage housing supply, including reductions in stamp duty for off-the-plan developments. These initiatives aim to stimulate the market and address the ongoing housing shortage.

- Sustainable Development: As Melbourne’s population grows, there is a push for sustainable and environmentally friendly developments. Properties that align with these values are likely to attract more interest from buyers and investors.

Strategic Investment Approaches

For those considering entering the Melbourne property market, a strategic approach is essential.

- Focus on Fundamentals: Look for properties with strong fundamentals, such as location, accessibility, and potential for growth. Avoid chasing trends that may not have long-term viability.

- Long-Term Perspective: Property investment requires time and patience. Those who hold onto their investments in the midst of market fluctuations are more likely to see substantial returns.

Conclusion – Melbourne Property Market

As 2025 draws near, the Melbourne real estate market is about to undergo a dramatic change. With a combination of economic recovery, population growth, and evolving buyer preferences, there are ample opportunities for savvy investors. However, navigating the challenges of supply constraints and regulatory changes will require careful planning and strategic decision-making. Investors can set themselves up for success in this dynamic and constantly changing environment by concentrating on high-growth suburbs and understanding the market dynamics.

Which Melbourne suburbs are expected to experience significant growth in 2025?

Several suburbs show promising growth potential, including Glen Waverley, Preston, Essendon, Bentleigh, and Reservoir. These areas offer unique advantages such as excellent schools, infrastructure upgrades, family appeal, transport access, and relative affordability.

How does Melbourne’s property market compare to Sydney’s in 2025?

Melbourne’s property prices are currently about 41% lower than Sydney’s, representing the widest gap in two decades. This significant price difference positions Melbourne as a potentially undervalued market with considerable upside for strategic investors.

What types of properties are likely to perform well in Melbourne’s 2025 market?

Townhouses in middle-ring suburbs, established family homes in gentrifying areas, and low-rise boutique apartments in premium locations are expected to show strong growth potential. These property types cater to various demographics and offer a balance of affordability and potential capital growth.

How is population growth affecting Melbourne’s property market?

Victoria’s population increased by over 183,000 people in 12 months, primarily driven by migration. This substantial growth, combined with record-low building approvals and a tight rental market, is creating significant pressure on housing supply and driving up property prices and rents.

What factors make 2025 a strategic entry point for Melbourne property investors?

The combination of undervalued market conditions, falling interest rates boosting buyer confidence, and Melbourne’s position in the property cycle (similar to Brisbane and Perth a few years ago) makes 2025 an attractive time for property investment in Melbourne. The market shows signs of transitioning from recovery to a growth phase.