Did you know that employers must contribute 11.5% of your earnings to your superannuation account? That’s a significant portion of money that could change value daily due to market movements.

However, many people rarely check their super balance, most only seeing it on statements issued every six months or annually. This means they might be missing essential changes in their retirement savings. Furthermore, having multiple super accounts can lead to unnecessary fees that eat into these savings. Now let’s dive in to the real reason why you’re here.

How to check your super?

Checking your super balance doesn’t have to be complicated. Whether through online portals, phone services, or traditional statements, there are several straightforward ways to track your retirement savings. This guide will walk through each method, helping you stay informed about your financial future.

Understanding Your Superannuation Basics

Superannuation is more than just a savings account—it’s money set aside during your working years to support you in retirement. It is designed to provide financial security when you stop working, with the government regulating contributions, taxation, and managing these funds.

What is Superannuation?

Superannuation is a long-term investment that grows over time. The money in your account is invested in various assets to increase your balance and provide the best possible retirement outcome. For most working Australians, super is a legal entitlement. If you’re over 18 and considered an employee for tax purposes, your employer must contribute to your super.

The Super Guarantee (SG) climbed to 11.5% of your regular time wages on July 1, 2024, with plans to climb to 12% by 2025–2026. This money is locked away until you retire or turn 65, creating a foundation for your retirement lifestyle.

Key information found in your super account

When checking your super account, you’ll typically find:

- Your current balance and contribution history

- Insurance details provided with your account

- Investment performance and strategy

- Fees being charged

- Your nominated beneficiaries

Most funds provide basic insurance coverage with your super account, offering protection if you become ill, injured, or die. Additionally, your statements will show your Tax File Number (TFN) status, essential for tracking your super efficiently.

How often should you check your super?

While super is a long-term investment, regular monitoring helps ensure you’re on track for retirement. Checking quarterly aligns with when employers make contributions, allowing you to verify they’re paying the correct amount. Moreover, annual reviews let you assess your investment strategy’s performance over time.

Although checking too frequently might cause unnecessary concern about short-term market fluctuations, being entirely hands-off isn’t advisable either. Focus on long-term performance rather than reacting to temporary market movements.

How to Check Your Super Balance Online

Checking your super account balance online offers the most convenient way to track your retirement savings. With digital access, you can monitor your super anytime and anywhere, allowing for better financial planning and peace of mind.

Setting up your online super account access

Initially, you must register for online access with your super fund. Most funds provide login details when you first join. If you haven’t received or misplaced these details, contact your super fund directly to set up a new super account. Registration typically requires:

- Your member number

- Personal identification details

- Creation of a secure password

Once your account is established, many funds will send confirmation details so you can complete the registration process.

Navigating your super fund’s website or app

After setting up your account, accessing your super information becomes straightforward. Most major super funds offer dedicated mobile apps with comprehensive account management features. Through these platforms, you can:

- View your current balance and performance over time

- Track contributions and fees

- Update your investment choices

- Manage insurance coverage

- Make additional contributions

The app is designed to be user-friendly, often allowing login via biometric authentication such as TouchID or FaceID for added security and convenience.

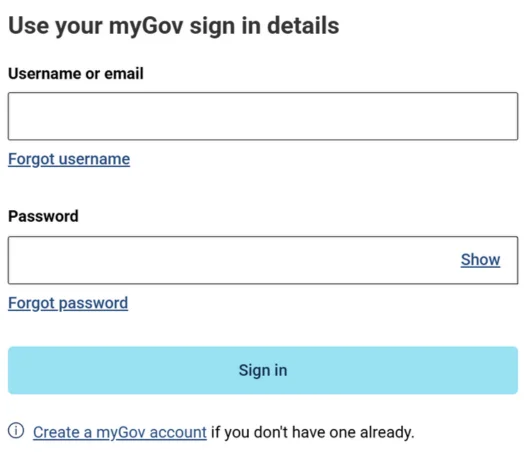

Using the MyGov portal to check your super

Beyond your fund’s website, the MyGov portal linked with Australian Taxation Office services provides a centralised way to manage your super. To access:

- Sign in to your myGov account

- Select “Australian Taxation Office”

- Navigate to the “Super” section

- Choose from information and management options

This service allows you to view all your super accounts in one place, check employer contributions, find lost super, and even consolidate multiple accounts.

Understanding the information displayed

When reviewing your super online, you’ll typically see:

Your current balance may differ from statement figures due to reporting timelines. The ATO portal generally displays the most recent 30 June balances, whilst your fund’s app shows more current statistics.

Additionally, you can view contribution caps, tax information, insurance details, and investment performance. Most platforms also display fees being charged, which is crucial for assessing the value you’re receiving from your fund.

Alternative Methods to Track Your Super

While online access provides convenience, several alternative methods exist for tracking your superannuation. These traditional approaches remain particularly valuable for those who prefer non-digital interactions or require detailed assistance.

Checking your super via phone

For those preferring verbal communication, contacting your super fund by phone offers a direct way to check your balance. First, locate your fund’s contact number on their website’s contact page. Before calling, gather your member number, full name, date of birth, address details, and possibly your employer’s name for verification purposes. Fund representatives can provide current balance information and answer questions about your account.

Reading and understanding your super statement

Your superannuation statement provides a comprehensive snapshot of your account, typically sent via post, email or both. These documents contain valuable information despite being issued only every six months or annually. When reviewing your statement, pay attention to the following:

- Your opening and closing balances

- Contribution history from employers and personal deposits

- Insurance coverage and associated premiums

- Investment performance compared to benchmarks

- Fees deducted from your account

- Current beneficiary nominations

Your statement’s ‘exit value’ or ‘withdrawal benefit’ figure represents what your fund reported to the ATO, which might differ from the closing balance. Contact your super fund directly if you notice discrepancies or don’t understand certain elements.

Visiting a branch or speaking with a representative

For complex questions or personalised guidance, visiting a branch or arranging a consultation with a superspecialist provides in-depth support. Many funds offer access to advice teams that can help with investment choices, additional contributions, insurance options, and retirement planning. These services range from simple account-related guidance to comprehensive financial advice.

To manage their accounts effectively, self-managed super fund holders might need to visit a branch with appropriate documentation, including original or certified copies of relevant papers.

How to Find Lost Super and Consolidate Accounts

Millions of Australians have lost track of their super accounts, with over AUD 30.58 billion in lost superannuation nationwide as of June 2019. This represents a significant opportunity to recover funds that rightfully belong to you.

Signs you might have lost super

You might have misplaced super if you’ve:

- Changed jobs multiple times

- Moved house without updating your details

- Changed your name (through marriage or otherwise)

- Lived or worked overseas

- Been automatically enrolled in your employer’s default fund

After these life transitions, many people lose their super savings. Before 2021, starting a new job often meant creating a new super account, leading to multiple accounts and lost funds.

Using MyGov to locate missing super

How to find my superannuation?

- Sign in or create a myGov account at my.gov.au

- Link your myGov account to the Australian Taxation Office (ATO)

- Select ‘Super’ from the ATO services menu

- View all your super accounts, including any you’ve forgotten

This service allows you to locate super held by your previous funds or the ATO itself. The ATO holds super on your behalf when your fund, employer, or the government cannot find an account to deposit your super into.

Steps to consolidate multiple super accounts

Once you’ve located your accounts, consolidation is simple:

- Log into myGov and access ATO online services

- Select ‘Super’ and then ‘Manage’

- Choose ‘Transfer super’ (this option appears only if you have multiple accounts)

- Select which fund to transfer from (the “transferring fund”) and to (the “receiving fund”)

What to consider before consolidating

Consolidating offers benefits like saving on fees and simplified management. Nevertheless, careful consideration is necessary:

- Insurance coverage: Check if you’ll lose valuable insurance that might be difficult or expensive to replace elsewhere

- Fund performance: Compare your accounts to decide which fund best suits your needs

- Employer contributions: Ensure your employer knows which fund to direct future contributions to

- Tax implications: If you intend to claim a tax deduction for personal contributions, complete this process before consolidating

Consequently, by combining your super, you’ll eliminate duplicate fees and gain better oversight of your retirement savings.

Troubleshooting Common Super Checking Problems

Even when armed with knowledge, checking your super can sometimes present unexpected hurdles. According to a recent report, account administration issues led to complaints about superannuation, with 4,391 cases reported—a 1% increase from the previous year.

What to do if you can’t access your account

If you’re unable to log into your super account online, first check for simple solutions:

- Try resetting your password

- Ensure permissions are set correctly in Access Manager

- Contact your fund directly via phone if online services aren’t working

For issues accessing the Small Business Superannuation Clearing House, check if you’re using the correct ABN or if certain characters in your entry aren’t accepted. Alternatively, the ATO app provides access to some services when website access is problematic.

Balance Discrepancies

Noting unexpected differences in your balance requires prompt action. First, verify your employer is making correct contributions by checking ATO online services or contacting your employer directly. According to the Australian National Audit Office, 95% of Employee Super Guarantee contributions are paid without ATO intervention, yet discrepancies still occur.

If contributions aren’t reaching your fund, invalid details might be the cause. Super funds reject payments when information doesn’t match, including incorrect names, dates of birth, or TFNs. Timing differences between when contributions are made and when they appear in your account might likewise explain apparent discrepancies.

Updating personal info

Keeping contact details current is essential to prevent lost super. You’ll need supporting documentation for name changes, whereas address updates typically require no additional evidence.

Most super funds have straightforward processes for updating details through their website or app. For security purposes, certified copies of identification documents may be required, especially for significant withdrawals.

When to seek professional help

Professional assistance becomes necessary with persistent issues. The Australian Financial Complaints Authority (AFCA) handles super-related complaints when your fund’s internal dispute resolution proves insufficient.

For severe financial hardship cases affecting super access, contacting the AFCA directly is advisable. Similarly, financial counsellors provide valuable guidance for those struggling with finances and super decisions. Remember that seeking help isn’t a sign of weakness but rather a step toward securing your financial future.

Conclusion – How to Check Your Super

Staying informed about superannuation balances is essential for securing a comfortable retirement future. Regular monitoring through digital platforms, traditional statements, or direct communication with fund representatives ensures proper management of retirement savings.

Understanding super basics, tracking contributions, and addressing discrepancies promptly helps maintain control over retirement funds. Most importantly, consolidating multiple accounts and to find lost super can significantly boost retirement savings by eliminating duplicate fees and maximising investment returns.

Supermanagement requires consistent attention rather than a set-and-forget approach. Though market fluctuations might cause temporary changes, maintaining updated personal information and addressing issues quickly safeguards long-term financial security. With this knowledge, anyone can effectively track and manage their superannuation, setting themselves up for a more secure retirement.

How can I check my superannuation balance?

You can check your super balance online through your fund’s website or mobile app, by logging into the MyGov portal and accessing ATO services, or by contacting your super fund directly via phone. Regular statements also provide detailed information about your balance and account activity.

What is superannuation, and why is it important?

A long-term savings plan called superannuation, or “super,” is intended to support a person’s finances in retirement. It’s important because it grows over time through employer contributions, personal deposits, and investment returns, helping to ensure financial security when you stop working.

How often should I review my superannuation account?

It’s advisable to check your super account quarterly to verify employer contributions and annually to assess overall performance. While frequent checking isn’t necessary due to the long-term nature of super, regular monitoring helps ensure you’re on track for retirement.

What should I do if I have multiple superannuation accounts?

If you have multiple super accounts, consider combining them for lower fees and to simplify management. You can use the MyGov portal to locate all your accounts and initiate the consolidation process. However, carefully review each account’s insurance coverage and performance before consolidating.

What information can I find in my superannuation statement?

Your super statement typically includes your current balance, contribution history, insurance details, investment performance, fees charged, and nominated beneficiaries. It provides a comprehensive account snapshot, usually issued every six months or annually.