With interest rates on hold after 13 consecutive rises, borrowing power has become a critical concern for prospective homeowners across the country.

In essence, borrowing power—also referred to as “borrowing capacity”—is the highest sum that a lender will grant you in order to buy a property. First-time buyers who understand how to calculate borrowing power gain a significant advantage in today’s uncertain market. Many lenders now offer a borrowing power calculator to help estimate how much money you could potentially borrow for your property purchase.

Your ability to qualify for greater loan amounts changes when interest rates rise because borrowing capacity declines and lenders must take the higher payback amounts into account. This is why understanding your financial position before house hunting is crucial. According to current regulations, lenders must apply a serviceability buffer of at least 3% when assessing loan applications. This guide explores everything first-time buyers need to know about determining their borrowing potential, from the factors lenders consider to practical steps for improving their borrowing capacity.

What Is Borrowing Power and Why Does It Matter

Borrowing power represents the maximum amount a lender will provide you based on your financial circumstances. Understanding this concept is fundamental to the home-buying process, as it directly influences which properties you can realistically afford.

Borrowing power isn’t merely determined by your income—it encompasses a comprehensive assessment of your financial situation. Lenders evaluate various factors, including your income stability, existing debts, living expenses, assets, and credit history, to determine how much you can comfortably repay without experiencing financial hardship.

How Borrowing Power Affects Home Search

Knowing your borrowing capacity early in the property-buying journey provides significant advantages. Furthermore, this knowledge allows you to:

- Set a reasonable budget for your property search

- Narrow down property options to those within your price range

- Avoid the disappointment of falling in love with properties beyond your means

- Begin preparing financially for future mortgage repayments

Once you understand your borrowing power, you can focus your search on suitable properties in locations matching your budget. Many prospective buyers find it beneficial to obtain pre-approval, which provides clarity about their borrowing capacity before they begin seriously looking at properties.

Why Lenders Care About Borrowing Capacity

Lenders meticulously assess borrowing capacity primarily to manage risk. Their calculations help determine whether you can maintain repayments without experiencing financial stress.

Lenders examine recent paystubs, tax returns, bank statements, and information about outstanding debts during the assessment process. They examine your income stability, employment history, and financial commitments. Additionally, lenders factor in potential interest rate increases to ensure you can handle higher repayments throughout your loan term.

The debt-to-income ratio serves as a critical metric during this evaluation. Lenders compare your income against your expenses and outstanding debts to calculate how much disposable income remains available for mortgage repayments.

Different lenders may assess borrowing capacity using varying criteria and calculations. Subsequently, shopping around can be worthwhile, as your borrowing power might differ significantly between financial institutions.

How Lenders Calculate Borrowing Power

Lenders employ sophisticated methods to determine exactly how much money they’re willing to offer you. Understanding these calculation methods can help you maximise your borrowing potential.

Income and Employment Stability

Lenders primarily assess your income stability and employment history. Full-time employees generally have an advantage over casual workers due to the predictability of their income. Most lenders consider your gross income (before tax) and may include additional sources such as bonuses, commissions, rental income, and government payments. Documentation typically includes payslips, tax returns, or financial statements for self-employed applicants.

Debt-to-Income Ratio and Credit Score

Your debt-to-income ratio (DTI) compares your total debt to your gross annual income. This crucial metric helps lenders gauge your capacity to manage monthly debt obligations. For example, a DTI of 6 means your debts equal six times your income. Many lenders set internal DTI caps, often between six and eight.

Moreover, your credit score has a significant impact on your borrowing power. A good credit history demonstrates financial responsibility and may increase your maximum loan amount.

Living Expenses and Number of Dependents

Lenders thoroughly examine your living expenses using benchmarks like the Household Expenditure Measure (HEM). This standardised tool estimates annual household expenditure based on:

- Your location

- Household type (single, couple, family)

- Number of dependents

- Lifestyle expense tier

Notably, having children increases assessed living expenses. For instance, a couple with two children could borrow approximately £688,045 compared to £840,944 without dependents.

Loan Type, Term, and Interest Rate

Longer loan terms and lower interest rates typically increase borrowing power by reducing assessed repayments—the loan type—whether owner-occupier or investment—likewise affects calculations. Interest-only periods might decrease borrowing capacity compared to principal and interest arrangements.

Serviceability Buffers and Risk Assessment

Ultimately, lenders apply a serviceability buffer—currently set at 3% by APRA—to ensure borrowers can handle potential interest rate increases. This means if your loan rate is 5.2%, your ability to make repayments is assessed at 8.2%. This buffer has reduced maximum loan sizes by approximately 5% for every 0.5 percentage point increase in the interest rate.

Factors That Can Increase or Decrease Your Borrowing Power

Several practical strategies can substantially impact your borrowing capacity when applying for a home loan. Understanding these factors provides first-time buyers with clear pathways to maximise their purchasing potential.

Reducing Existing Debts

Outstanding debts significantly diminish your borrowing power. A personal loan with monthly repayments of just AUD 764.50 can reduce your borrowing capacity by approximately AUD 236,993.49. Similarly, HECS-HELP debts can decrease borrowing power by approximately AUD 128,435.18 for someone earning AUD 152,899.02 per annum. Consider paying off smaller debts altogether and consolidating larger ones where possible. In fact, clearing or reducing debts should ideally begin at least six months before approaching lenders.

Improving Your Credit Score

Your credit score directly affects both your chances of loan approval and your borrowing capacity. Regular bill payments, maintaining a consistent repayment history, and minimising credit applications all contribute to a stronger credit profile. Checking your credit report annually through services like Equifax, Experian, or illion helps identify and correct potential issues.You can get better interest rates and bigger borrowing limits by making even minor changes to your credit score.

Saving for a Larger Deposit

A larger deposit provides multiple advantages beyond reducing your loan amount. It demonstrates financial discipline, lowers your loan-to-value ratio (LVR), and potentially eliminates Lenders Mortgage Insurance requirements. Furthermore, borrowers with deposits of 20% or more typically save up to 1% per year in interest compared to borrowers with lower deposits. Consider setting up automatic transfers to high-interest savings accounts or directing windfalls, such as tax refunds, toward your deposit fund.

Lowering your Credit Card Limits

Lenders assess credit cards based on their limits rather than balances. Even unused credit limits affect borrowing power, with each AUD 1.53 of limit reducing borrowing capacity by approximately 6.4 times. For example, a credit card limit of AUD 15,289.90 could reduce borrowing power by AUD 71,862.54. Practically speaking, reducing a credit limit from AUD 30,579.80 to AUD 15,289.90 could increase borrowing capacity by AUD 76,449.51.

Minimising Lifestyle Expenses

Lenders scrutinise your spending habits through the Household Expenditure Measure (HEM) when calculating serviceability. Reducing unnecessary expenses—particularly in the three months before applying for a loan—can substantially improve your position. One couple who trimmed their monthly expenses by AUD 611.60 by cancelling subscriptions and reducing dining out increased their borrowing power by approximately AUD 30,579.80 without changing their income. Consider reviewing insurance policies, subscriptions, and discretionary spending to boost your borrowing capacity.

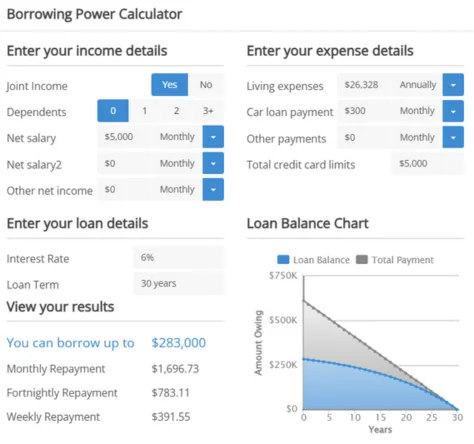

Using a Borrowing Power Calculator Effectively

Online borrowing power calculators offer a quick way to gauge your potential loan amount without booking appointments or speaking with lenders. These tools require specific information to generate meaningful estimates.

Information Neccessary

Most calculators ask for:

- Annual income (before or after tax)

- Additional income sources, like rental returns or bonuses

- Monthly expenses and living costs

- Existing debts, including personal loans and HECS/HELP

- Credit card limits (not just balances)

- Number of dependents in your household

Meanwhile, some calculators automatically include the Household Expenditure Measure to estimate minimum living costs if your declared expenses seem unrealistically low.

Interpreting the Results

Upon completion, calculators display an estimated borrowing amount along with potential repayments. Initially, view these figures as starting points rather than guarantees. The results typically assume a 30-year loan term with principal and interest repayments. Remember that different lenders use varying assessment rates, which directly affect your borrowing capacity.

Scenario Planning with Interest Rate Changes

Practical calculators allow you to adjust variables to see how they affect your borrowing power. Obviously, even small interest rate changes can have a dramatic impact on results. For instance, a 0.5% rate increase could reduce borrowing capacity by approximately £59,630. Fortunately, many calculators include features to model potential rate rises, helping prepare for future market changes.

Limitations of Online Calculators

Regardless of their usefulness, these tools have significant limitations. They often exclude:

- Detailed credit score analysis

- Employment stability assessment

- Precise calculations of all income types (many lenders don’t count 100% of overtime or commissions)

- Loan fees and establishment costs

- Accurate serviceability buffers (which vary between lenders)

Primarily, calculators provide estimates only—they don’t constitute loan approvals. For accurate figures, consulting with mortgage professionals remains essential.

Conclusion – Borrowing Power

Understanding your borrowing power represents a crucial first step for any first-time buyer entering the property market. Throughout this guide, we have examined how lenders determine your borrowing capacity through assessments of income stability, debt-to-income ratios, living expenses, and credit history. Additionally, we explored practical strategies to improve your position before approaching lenders.

Reducing existing debts, improving credit scores, and saving for larger deposits all contribute significantly to increasing your borrowing power. Credit card limits, surprisingly, affect your borrowing capacity regardless of balance; therefore, reviewing and reducing these limits makes financial sense. Likewise, minimising unnecessary lifestyle expenses demonstrates financial responsibility to potential lenders.

Ultimately, borrowing power knowledge empowers you to search for properties within realistic price ranges, preventing disappointment and financial strain. Armed with this understanding, you can approach the property market confidently and make informed decisions about your first home purchase. Remember, lenders thoroughly assess your financial position to ensure loan sustainability. Your preparation accordingly determines your success in securing appropriate financing for your property journey.

How does borrowing power affect my property search?

Understanding your borrowing power helps you set a realistic budget for your property search, focus on the right options within your price range, and avoid disappointment from considering properties beyond your means. It also allows you to prepare financially for future mortgage repayments.

What factors do lenders consider when calculating borrowing power?

Lenders assess various factors, including income stability, employment history, debt-to-income ratio, credit score, living expenses, number of dependents, loan type, and interest rates. They also apply serviceability buffers to ensure borrowers can handle potential interest rate increases.

Are online borrowing power calculators accurate?

Online calculators offer helpful estimates, but they have limitations. They often don’t account for detailed credit score analysis, employment stability, or precise calculations of all income types. While useful for initial planning, they shouldn’t be considered as loan approvals. Consulting with mortgage professionals is essential for accurate figures.

How do interest rate changes affect borrowing capacity?

Interest rate changes can significantly impact borrowing capacity. Even a small increase in interest rates can substantially reduce the amount you can borrow. For example, a 0.5% rate increase could decrease borrowing capacity by approximately £59,630. It’s important to consider potential rate rises when planning your property purchase.