Financial illiteracy affects approximately 8.5 million Australian adults, with 45% of the population struggling to understand basic financial concepts. Despite living in a developed economy, over a quarter of Australians are unable to answer simple questions about interest rates, inflation, etc. This knowledge gap has been widening, particularly among young people, according to the 2020 Household, Income and Labour Dynamics in Australia (HILDA) study.

Financial literacy in Australia presents a concerning gender disparity, with 63% of men demonstrating basic financial literacy compared to just 48% of women. The problem begins early, with only 28% of teenage boys and 15% of teenage girls demonstrating financial understanding. Furthermore, enrolment in Year 12 economics courses has plummeted by approximately 70% since the early 1990s. This decline is especially pronounced among girls, regional students, and other underrepresented groups.

While Australia grapples with these challenges, other nations have implemented more robust approaches to financial education. Denmark, for instance, made financial education compulsory in their National Curriculum in 2015 for students aged 13 to 15, contributing to its impressive 71% financial literacy rate—one of the highest globally. This stands in stark contrast to Australia’s 45% rate.

Defining Financial Literacy in the Australian Context

The Organisation for Economic Co-operation and Development (OECD) defines financial literacy as a collection of financial awareness, skills, knowledge, attitudes, and behaviours required to make prudent financial decisions and achieve personal financial well-being. “The ability to understand and apply different financial skills effectively, including personal financial management, managing debt, investing, budgeting, and saving” is how the VCAA defines it in Australia.

Financial Literacy Definition and Scope

Financial literacy encompasses several interconnected elements. According to the National Financial Capability Strategy, these include financial knowledge (understanding concepts such as inflation and interest), financial skills (the ability to compare products and avoid scams), financial attitudes (a mindset about finances), and financial confidence (a belief in one’s ability to manage finances). The RBA notes that financial literacy requires basic numeracy skills to calculate rates of return on savings and borrowings, as well as an understanding of the risk-return trade-off.

Why Financial Literacy Matters for Modern Australians

Financial literacy has become increasingly crucial as financial products have grown more complex. Consequently, Australians now navigate a bewildering array of banking products, mortgage options, and credit card permutations. The financially astute increase their chances of reaching financial objectives like home ownership and retirement planning by recognising the value of careful financial planning at a young age.

Additionally, financial literacy serves as protection against costly mistakes. Those lacking financial education often fall prey to scams or pursue high-risk investments without understanding associated dangers. Research shows that 77% of Australians have financial regrets, with the top three relating to behaviours such as not saving, investing or budgeting.

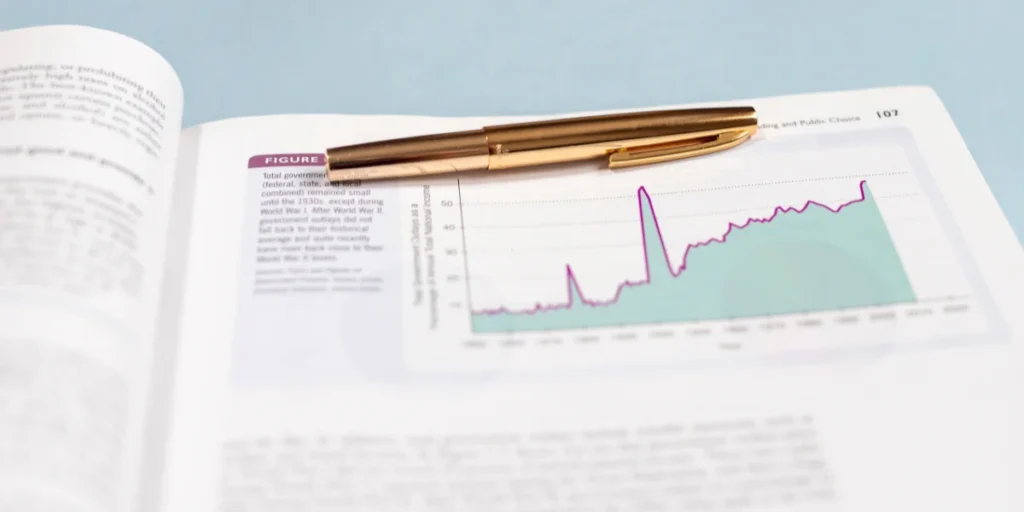

Link to Economic Participation and Personal Well-Being

Financial capability connects directly to broader economic participation. According to Melbourne Law School research, improving financial literacy aligns with “increasing economic participation and social inclusion, driving competition and market efficiency in the financial services sector”. Furthermore, a Commonwealth Bank study calculated that over the course of ten years, raising financial literacy among the 10% of Australians with the lowest level of financial literacy would boost GDP by AUD 9.17 billion and generate over 16,000 new jobs.

On a personal level, financial health and mental well-being are inextricably linked. Financial challenges cause significant stress, impacting mental health, just as poor mental health can make managing finances more difficult. Australian Unity and Beyond Blue research confirms this strong relationship, with financially capable individuals experiencing greater overall wellbeing.

Realted Article: Job Market in Australia 2025: Redundancies, Restructures & Recovery Paths

Current Gaps in Financial Literacy Education in Schools

Despite widespread agreement on the importance of financial education, with 98% of parents supporting its inclusion in schools, the Australian education system continues to fall short in preparing young people for the financial challenges they will face.

Curriculum Limitations in Years 7–10 Economics and Business

Currently, financial literacy is not a mandatory subject in the Australian curriculum. Instead, financial concepts are primarily introduced within mathematics subjects, where they are approached through a calculative lens that focuses on formulas rather than practical skills. This mathematical framing creates significant barriers, particularly for students who struggle with or disengage from mathematics. Research indicates many students fixate on calculations without grasping underlying concepts. Indeed, only 65% of students report learning about money and finance at school, with 37% acknowledging they have no or low financial knowledge.

Inconsistencies Across State and Territory Syllabuses

Notably, implementation of financial education varies considerably across Australia’s educational landscape. Although financial literacy concepts are embedded in the Australian Curriculum up to Year 10, they are not taught as a standalone subject. Therefore, student exposure differs dramatically:

- The National Australian Curriculum incorporates financial literacy within Mathematics

- The NSW Curriculum places these skills within Studies of Society and Environment (Commerce)

- Other states have their own approaches to implementation

This inconsistent delivery means many students miss crucial financial literacy concepts entirely in their later years of schooling. Teachers, who play an important role in delivering financial education, often lack confidence, with less than half (44%) feeling very confident teaching it.

Over-Reliance on Home-Based Financial Education

As a result of these curriculum gaps, more than 50% of students learn essential financial skills, such as budgeting, saving, and employment-seeking, from their parents or guardians. Unfortunately, this creates a troubling cycle as 45% of Australian adults are themselves financially illiterate. Home environments vary significantly, with many students not living with their parents and others having parents who are unable to provide financial guidance. This situation perpetuates economic discrepancies as younger generations inherit limited or even harmful financial habits.

Related Article: UK Student Debt Crisis: Average Graduate Now Owes £45,000

Policy and Curriculum Reform Initiatives

In response to growing concerns about financial illiteracy, several reform initiatives are underway to strengthen Australia’s financial education framework.

Proposal to Integrate ‘Personal Finance’ into the National Curriculum

A significant recommendation proposes integrating ‘personal finance’ as a mandatory content area within the National Curriculum’s ‘Economics and Business’ subject for Years 7 to 10. This approach aims to provide consistent and comprehensive financial education across all schools, specifically covering essential skills like saving, budgeting, and investing. Currently, financial literacy is often presented as a component within broader Mathematics and Humanities subjects, rather than as a standalone educational focus.

Amendments to ACARA’s Charter and Schedule 1

The proposed reform includes specific amendments to Schedule 1 of ACARA’s Charter to add explicitly ‘and Personal Finance’ alongside the core ‘Economics and Business’ content area. This formal recognition would elevate the status of financial education within the curriculum framework. Success would be measured through standardised financial literacy assessments, potentially including a personal finance aptitude test within NAPLAN.

Projected Costs and Implementation Timeline (2024–2028)

The implementation requires substantial investment—initially estimated at AUD 22.93 million over two years, followed by an annual maintenance cost of AUD 3.06 million for ongoing monitoring, evaluation, and updates. The Victorian Curriculum F–10 is scheduled for implementation from 2025, with changes to Economics and Business following in 2026. Complete national implementation is projected for the next curriculum review, scheduled for 2028.

International Models and Lessons for Australia

Several countries around the world offer instructive models for addressing financial illiteracy through education reforms.

Denmark’s Compulsory Financial Education (ages 13–15)

Since 2015, financial education has been mandatory in Denmark’s national curriculum for students aged 13 to 15. This programme covers essential skills including budgeting, savings, comparing different types of loans, consumer rights, and banking operations. The structured approach has yielded impressive results, with Denmark achieving a 71% financial literacy rate—amongst the highest globally. Annually, approximately 20,000 students across 700 Danish schools participate in Money Week, where financial sector professionals visit classrooms.

New Zealand’s 2025 Curriculum Reform Plan

New Zealand recently announced that financial education will become a core element of its refreshed social sciences curriculum. Scheduled for implementation from 2026 and becoming compulsory in 2027, this curriculum adopts a staged approach—younger students learn basics such as identifying needs versus wants, while older learners explore budgeting, investment, interest, taxes, and insurance. The Ministry of Education has partnered with the Retirement Commission to ensure the provision of consistent, curriculum-aligned resources.

US State-Level Mandates for Personal Finance Courses

Currently, 30 states across America require students to complete personal finance courses before graduation. Recent additions include Delaware, Texas, Colorado, and Kentucky. However, this state-by-state approach has resulted in inconsistent implementation nationwide, with many states still lacking comprehensive requirements.

Conclusion – Financial Literacy

Financial literacy education stands at a critical crossroads in Australia. The alarming statistics—with nearly half the adult population struggling to grasp basic financial concepts—underscore the urgency for educational reform. This knowledge gap, particularly pronounced among young people and women, reflects systematic failures rather than individual shortcomings.

Australia must acknowledge financial literacy as an essential life skill rather than an optional educational extra. The projected implementation timeline (2024-2028) presents a reasonable framework for meaningful change; however, success will depend on adequate funding, practical teacher training, and consistent evaluation methods.

Financial literacy education ultimately represents an investment in Australia’s future. The path toward a financially capable population requires commitment from educational authorities, adequate resources for schools, and recognition of financial education as fundamental to preparing young people for modern life. The proposed reforms, therefore, deserve wholehearted support from all stakeholders committed to Australia’s economic and social well-being.

Why is financial literacy important for Australians?

Financial literacy is crucial for Australians as it enables them to make informed decisions about complex financial products, plan for their future, and protect themselves from scams. It also contributes to overall economic participation and personal well-being.

How does Australia’s financial literacy education compare to other countries?

Australia lags behind some countries in financial literacy education. For example, Denmark made financial education compulsory for students aged 13-15 in 2015, resulting in a 71% financial literacy rate, while Australia’s rate is around 45%.

What are the current gaps in financial literacy education in Australian schools?

Financial literacy is not a mandatory subject in the Australian curriculum. It’s primarily taught within mathematics, which can be limiting. There are also inconsistencies across states and territories, and many students rely on home-based financial education.

What reforms are being proposed to improve financial literacy education in Australia?

There’s a proposal to integrate ‘Personal Finance’ as a mandatory content area within the National Curriculum’s ‘Economics and Business’ subject for Years 7 to 10. This would provide consistent and comprehensive financial education across all schools.

How much will the proposed financial literacy education reforms cost?

The implementation of the proposed reforms is estimated to cost AUD 22.93 million over a two-year period, with an annual maintenance cost of AUD 3.06 million for ongoing monitoring, evaluation, and updates.