The company has invested in its sixth Disney cruise ships, Disney Treasure. Disney Cruise is doubling down on cruise ships, with the newest version scheduled to make its maiden voyage on December 21st. By 2031, the company plans to launch seven additional ships. The launch of new Disney cruise ships represents an era of growth and expansion for the company.

Before introducing Treasure, the company launched its sister ship, Disney Wish, in 2022. This came after close to a decade of no launches. By the end of 2025, three Disney cruise ships Disney Destiny and Disney Adventure will be launched, with five more to follow throughout the next six years. With all the new launches and announcements, Wall Street analysts believe it’s time to pay attention to what’s really going on.

An analyst from Morgan Stanley, Ben Swinburne, said in an interview with Yahoo Finance, “We think that these businesses have a higher return on invested capital than your average non-Disney cruise business.” He continued and mentioned the high occupancy levels and revenue-per-room rates, considering that the majority of cruise ship passengers are families.

Disney Treasure Capacity

Disney Treasure

The newest cruise ship, Disney Treasure can carry a maximum of 4,000 passengers and an additional 1,555 crew members. Prices for the voyage begin at $8,511 per individual. As of now, all rooms are sold out.

Check out Disney Cruise Australia for Special Pricing and Insights Now.

Swinburne, “That’s obviously a recipe for a very profitable investment. We think it’s a positive for the company that they’re investing to grow this business.”

In an interview with ABC’s Good Morning America, the CEO of Disney, Bob Iger, mentioned that Disney cruise ships are taking over stays at the theme park. Since the Disney cruise ships are all-inclusive, consumers prefer cruise vacations rather than pricey theme park visits.

Disney Cruise Ships – Stock Importance

As Disney theme park visits have experienced slower business, investors have grown concerned. The prices have risen, and demand has been less. Hugh Johnston, Disney’s CFO, earlier this month mentioned that operating income in the experiences category, which comprises parks, Disney cruise ships, and consumer items, is forecast to improve next year, with growth ranging between 6% and 8%.

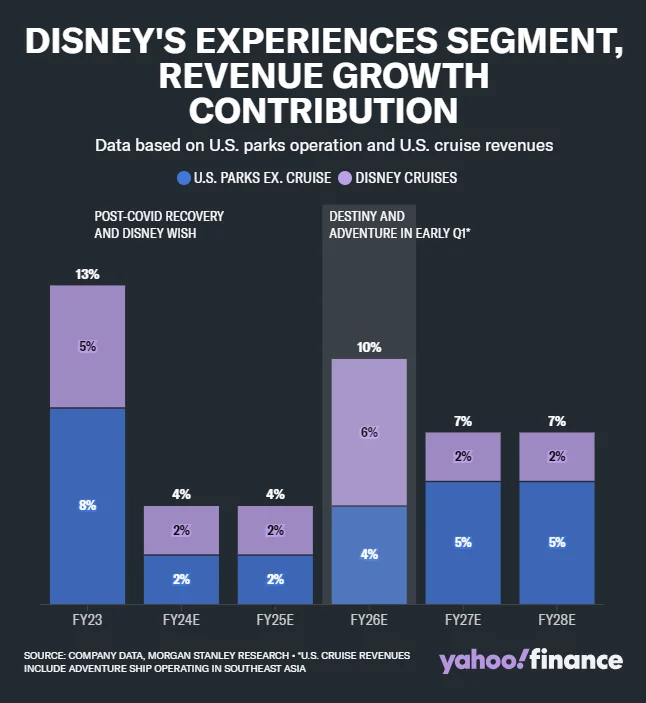

Johnston stressed the Disney Treasure ship as the main catalyst for growth. In response to clients in the previous month, Swinburne estimated that cruise capacity will significantly rise from 5,500 staterooms to over 10,000 by 2026. He mentioned that this positions Disney cruise revenues to double from the end of 2024 through the end of 2027.

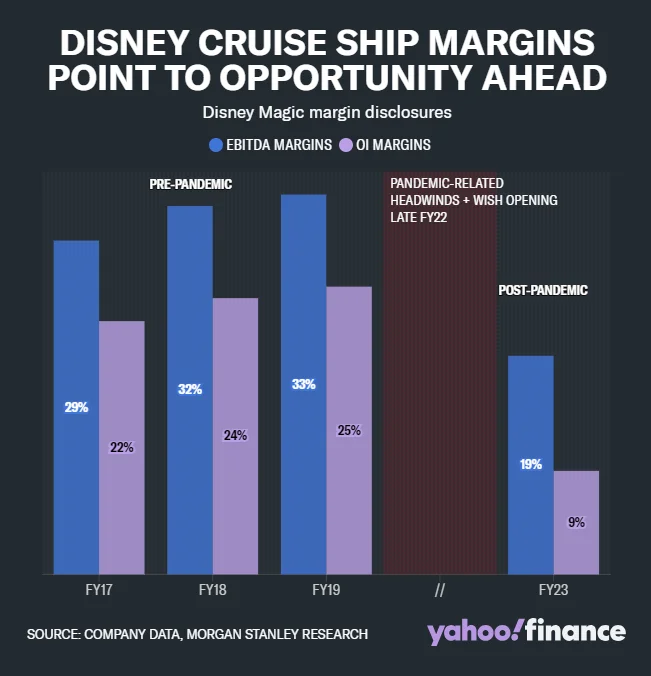

While Disney doesn’t consider financial metrics for its ships, Swinburne and his team uncovered information from the Magical Cruise Company. The analyst said, “While still relatively modest in size when compared to the overall US parks business and even smaller relative to the experiences segment, this business is not insignificant in terms of contributions to growth and margins.”

According to Morgan Stanley, cruise revenues are likely to rise as a percentage of US-based experiences, as seen in the chart below. The company predicts that cruises will account for most of the segment’s US sales increase in 2026, with two ships expected to launch in late 2025.

In addition to revenue growth, operating margins have increased. According to the Morgan Stanley team, the Magical Cruise disclosure revealed operating income margins ranging from 20% to 25% for the cruise industry before the pandemic.

While the margins still have a long way to go, the analyst team said, “both Disney’s historical cruise margins and public cruise comps indicate an opportunity for meaningful operating income contribution ahead.”

Swinburne concluded by telling Yahoo Finance investors that over the years, they have built curiosity regarding where cruises are headed, specifically recently, which is highly dependent on Disney’s future income. The analyst compared cruise ship businesses to other Disney growth avenues. He considers 2032 the year all their cruises will launch. Morgan Stanley says this will bring in at least $9 billion in revenue and close to $2.3 billion in income.

Meanwhile, Disney’s sports sector, consisting of its flagship ESPN network, recently announced revenue of $17.6 billion and operating income of $2.4 billion until September 28th. In other words, Disney cruise ships, which generate nearly half the revenue of Disney’s sports business, are expected to generate approximately the same earnings as the sports division recorded this year.

Swinburne said, “The cruise ships play a very important role. For those of us focused on Disney growth avenues and the company’s ability to deliver or outperform expectations, understanding the timing of cruise launches and the earnings contribution of launches is actually very important. And it’s very important to the stock.” Swinburne has passed over a message that stock importance for Disney cruise ships is something investors should be paying attention to.