Trump’s latest declaration that Nvidia Blackwell chips should be available only to US customers signals a dramatic shift in global AI policy. The restriction targets the world’s most valuable company by market capitalisation, which recently reached an unprecedented $5 trillion valuation.

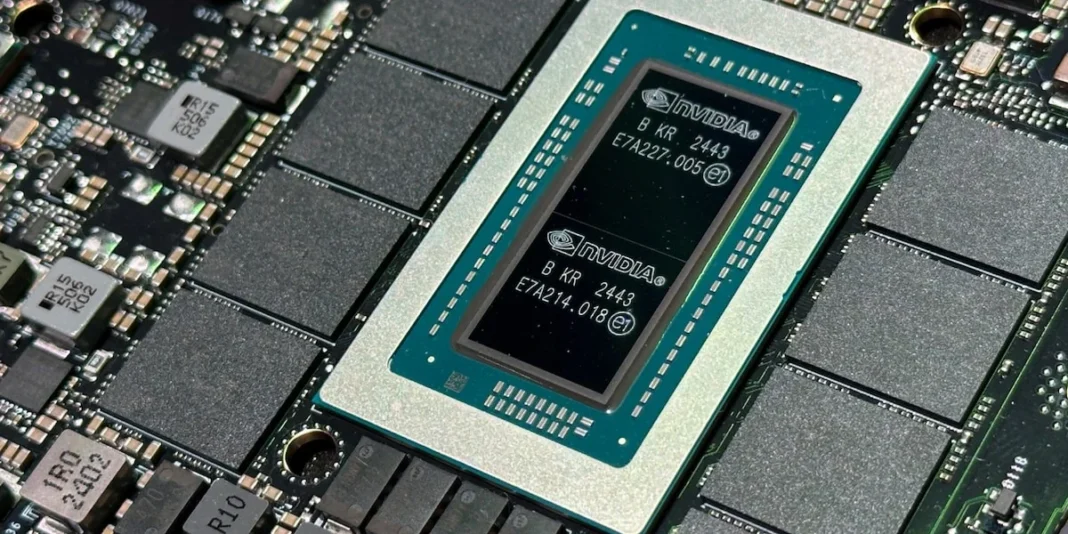

Amid this growing technological divide, the Nvidia AI chip controversy has sparked international concern. The company’s Blackwell chip, widely considered the most sophisticated semiconductor for artificial intelligence applications, now faces uncertain global distribution. Despite these limitations, Nvidia plans to supply more than 260,000 Blackwell chips to South Korea and major businesses like Samsung Electronics. However, the Nvidia Blackwell release date and Nvidia Blackwell price considerations are now complicated by these potential export restrictions, which appear to be stricter than previously indicated by US officials. Furthermore, these advanced chips are central to powering AI systems globally, from self-driving cars to defence technologies.

Trump Restricts Nvidia Blackwell Chips to US Firms

US President Donald Trump has definitively stated that Nvidia’s advanced Blackwell chips will remain exclusively available to American companies, effectively cutting off China and other nations from accessing this cutting-edge AI technology.

Trump Reiterates Chip Ban

In a CBS “60 Minutes” interview, Trump was explicit about restricting access to Nvidia’s most sophisticated semiconductors. When questioned about China’s desire for advanced chips, Trump responded, “The most advanced, we will not let anybody have them other than the United States”. When he spoke to reporters on Air Force One upon his return from Florida, he reaffirmed this stance by saying categorically, “We don’t give that chip to other people”.

The President described the technological edge of the Blackwell architecture as substantial, noting it is “10 years ahead of every other chip“. His comments come shortly after he meets with Chinese President Xi Jinping in South Korea, where semiconductors were discussed but specifically not the Nvidia Blackwell chip.

Trump indicated some flexibility regarding less capable versions of Nvidia’s technology, telling CBS, “We will let them deal with Nvidia but not in terms of the most advanced”. He had previously suggested the possibility of permitting export of downgraded models, mentioning “a somewhat enhanced, in a negative way, Blackwell chip… take 30% to 50% off of it”.

Statement Signals Tighter Export Controls

The President’s recent statements suggest his administration may implement stricter limitations than analysts had anticipated. Rather than focusing solely on China, Trump’s comments suggest the potential for broader restrictions that could affect global markets. This approach represents a significant intensification of existing export control policies.

The possibility of allowing any version of Nvidia Blackwell chips to be sold to Chinese firms has drawn sharp criticism in Washington. Republican Congressman John Moolenaar, who chairs the House Select Committee on China, compared such a move to “giving Iran weapons-grade uranium”, highlighting security concerns among lawmakers from both parties.

Experts warn about the competitive implications of these restrictions. According to security analysts, if the US permitted exports of Nvidia Blackwell chips to China, Chinese computing capacity could potentially surpass American capabilities by 2026. Conversely, completely blocking exports would maintain a substantial American advantage, with the US potentially having 30 times the AI computing power of China.

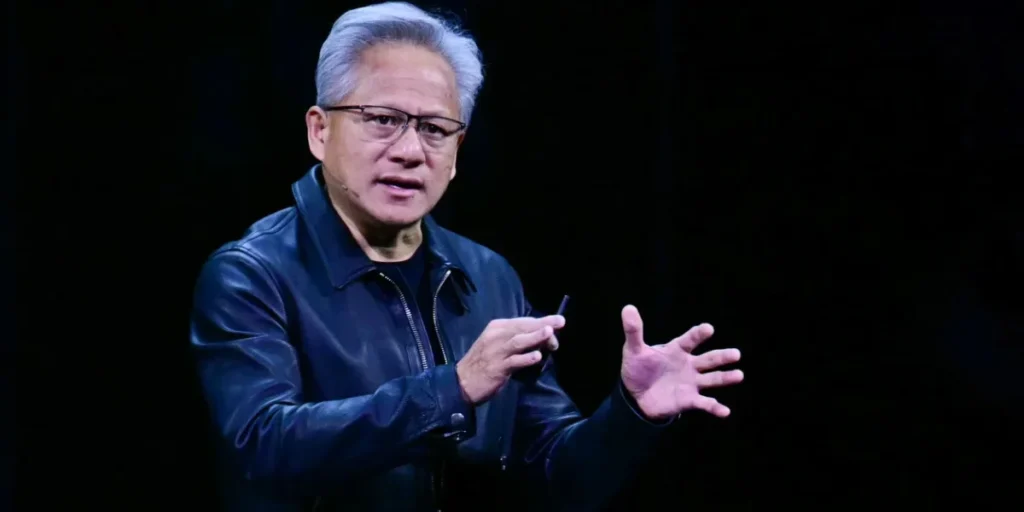

Nvidia CEO Jensen Huang acknowledged the situation, noting that the company has not sought US export licences for the Chinese market, partly because “they’ve made it very clear that they don’t want Nvidia to be there right now”. This represents a dramatic shift for Nvidia, whose market share in China has reportedly fallen from 95% to zero due to US restrictions.

Why is China Excluded from Nvidia’s AI Chip Access?

The exclusion of China from access to Nvidia Blackwell technology stems from growing strategic concerns about technological advantages in artificial intelligence. Unlike previous chip restrictions, the Blackwell ban reflects broader apprehensions about Beijing’s technical capabilities.

Military Use and AI Acceleration

National security officials point to the dual-use nature of advanced Nvidia AI chips as a primary reason for restricting exports. These semiconductors can accelerate not only civilian applications but also military technologies, including weapons systems, surveillance networks, and cyber capabilities. Intelligence assessments indicate China could potentially leapfrog American AI computing power by 2026 if given access to Blackwell architecture.

The Pentagon views this technology gap as essential for maintaining strategic advantages. Military analysts note that unrestricted chip sales would essentially transfer critical technological capabilities to a strategic competitor. Additionally, there are concerns about China’s integration of civilian and military technology development through its “Military-Civil Fusion” strategy.

Lawmakers Compare Chip Sales to Nuclear Proliferation

Congressional opposition to any Blackwell exports to China has been particularly fierce. Representative John Moolenaar, who chairs the House Select Committee on China, notably compared selling downgraded Nvidia Blackwell chips to Beijing as equivalent to “giving Iran weapons-grade uranium.” This nuclear proliferation analogy reflects the perceived severity of the strategic implications.

Senator Marco Rubio expressed similar concerns, stating that allowing even modified versions of Nvidia Blackwell chips to reach Chinese firms would represent an unacceptable national security risk. Both Republican and Democratic lawmakers have formed an unusual alliance in opposing any compromise on this issue.

Trump Hints at Limited Chip Access

Whilst Trump initially suggested the possibility of selling downgraded versions of Nvidia Blackwell chips to Chinese companies—specifically mentioning taking “30% to 50% off” their capabilities—these statements triggered immediate backlash. Security experts calculate that maintaining the complete ban gives the United States potentially 30 times the AI computing power of China.

Following widespread criticism, Trump appears to have hardened his position, subsequently emphasising that “the most advanced, we will not let anybody have them other than the United States.” Nevertheless, his earlier remarks about potential compromises continue to generate unease among security analysts and lawmakers alike.

How Nvidia is Navigating the Global Tech Divide

Amid escalating tech tensions, Nvidia has forged strategic partnerships outside of China while acknowledging its diminished market position in China. The chipmaker’s approach reveals a pragmatic response to geopolitical realities.

Nvidia to Supply 260,000 Blackwell Chips to South Korea

Nvidia announced a significant deal to supply more than 260,000 of its most advanced AI chips to South Korea’s government and leading businesses. This arrangement includes Samsung Electronics, SK Group, and Hyundai Motor Group, with each deploying up to 50,000 AI chips in smart factories. Meanwhile, Naver, Korea’s largest internet portal, will purchase 60,000 Nvidia chips. Jensen Huang framed this partnership as enabling South Korea to “now produce intelligence as a new export”. The agreement aims to establish South Korea as a regional AI hub under President Lee Jae Myung’s administration.

CEO Jensen Huang says China doesn’t want Nvidia chips

In a striking admission, Huang recently stated, “We used to have 95% share of the AI business in China. Now we’re at 0% share”. At another event, he noted, “At the moment, we are 100% out of China”. Consequently, Nvidia now assumes zero revenue from China in its forecasts. Although Huang has expressed hope to sell Nvidia Blackwell chips to China eventually, he maintains that technological exchange would benefit both nations.

Nvidia Avoids Applying for US Export Licences to China

The company has refrained from seeking export licences for the Chinese market. Huang explained this decision, stating: “They’ve made it very clear that they don’t want Nvidia to be there right now”. Nevertheless, Nvidia considers China “a singular, vital, important, dynamic market” that “nobody can replace”. In response to export restrictions, Nvidia has developed modified architectures, such as the B20 chip, tailored to comply with US export controls while maintaining competitiveness.

The Global AI Race

The semiconductor rivalry between America and China is reshaping global technology landscapes. This tech confrontation transcends mere trade disputes, marking a fundamental transformation in how AI capabilities are developed worldwide.

US Asserts Tech Control Through Chips

The American strategy combines aggressive export controls with domestic investment through the CHIPS Act, which provides AUD 79.51 billion to enhance research and manufacturing. This “chokepoint” approach restricts China’s access to advanced semiconductors and associated technologies. By controlling Nvidia Blackwell chips, Washington aims to maintain its commanding lead at the technological frontier. Security analysts calculate that completely blocking exports could give the US potentially 30 times the AI computing power of China.

China’s Domestic AI Chip Development Accelerates

Facing technological containment, Beijing has dramatically intensified its semiconductor self-reliance campaign. China reportedly aims for 70% data centre chip self-sufficiency by 2027, investing over AUD 382.25 billion in semiconductor manufacturing since 2019. Consequently, its domestic chip production capacity has tripled to approximately 20% of global capacity. Huawei’s Ascend 910B reportedly delivers about 85% of Nvidia’s H20 performance, whilst locally developed AI chips are projected to capture 55% of China’s market by 2027.

Global Supply Chains Face Fragmentation

This technological decoupling is creating “two parallel technological universes”. Companies are increasingly facing a bifurcated market where geopolitical alignment determines their survival. This fragmentation extends beyond manufacturing as multinational firms must localise technology architecture for different markets. The era of seamlessly integrated global semiconductor supply chains appears “decisively over”, replaced by regionalised blocs and technological barriers that force other countries to navigate separate technology ecosystems with incompatible standards.

Conclusion – Nvidia Blackwell

The restriction of Nvidia Blackwell chips to US markets undoubtedly signals a watershed moment in global technology policy. This decision effectively redraws technological boundaries worldwide while cementing America’s determination to maintain AI supremacy. Although Trump initially suggested the possibility of downgraded versions for Chinese markets, subsequent statements have clarified his administration’s intention to keep cutting-edge semiconductor technology firmly within US borders.

Consequently, Nvidia has pivoted its global strategy, forging significant partnerships with South Korean firms while acknowledging its complete withdrawal from Chinese markets. In order to adapt to the changing geopolitical reality of technology distribution, the corporation now supplies hundreds of thousands of sophisticated chips to allies rather than rivals.

The fallout from these restrictions extends beyond immediate market impacts. Technology companies must adapt to a world where geopolitical considerations outweigh pure business logic. Governments outside the US-China rivalry face difficult choices about aligning their technology policies with either of these powers. Ultimately, this semiconductor standoff represents not just a competition for market share, but a contest for future technological leadership that will shape global power dynamics for decades to come.

What are Nvidia Blackwell chips, and why are they significant?

Nvidia Blackwell chips are advanced semiconductors designed for artificial intelligence applications. They are considered the most sophisticated AI chips available, powering various technologies from self-driving cars to defence systems.

Why has the US restricted the export of Nvidia Blackwell chips?

The US has restricted these chips due to national security concerns. There are concerns that unrestricted access could enable other countries, particularly China, to rapidly advance their AI and military capabilities, potentially surpassing the US’s technological advantages.

How is Nvidia adapting to these export restrictions?

Nvidia is focusing on partnerships with US allies, such as supplying over 260,000 Blackwell chips to South Korea. The company has also stopped seeking export licences for the Chinese market and is developing modified chip architectures to comply with US export controls.

What impact will these restrictions have on the global AI race?

These restrictions are likely to create a more fragmented global technology landscape. The US aims to maintain its AI supremacy, while China is accelerating its domestic chip development. This could lead to the creation of parallel technological ecosystems with potentially incompatible standards.

How might these chip restrictions affect businesses and consumers worldwide?

Companies may face challenges navigating a bifurcated market where geopolitical alignment influences business decisions. Consumers might experience differences in AI-powered products and services depending on their region, as technological development becomes increasingly localised and subject to geopolitical considerations.