Budgeting apps are becoming essential tools for Australians struggling to save money. According to an InfoChoice survey, more than one in four Australians don’t budget at all, while nearly one in six have less than $1,000 in savings, and one-third have less than $5,000.

Fortunately, the best budget apps do more than just track expenses. They utilise Open Banking to securely connect with your bank accounts, providing read-only access to your financial data. Top budgeting apps also offer customisable categories that help tailor your budget to specific financial goals and lifestyle needs. In fact, these good budgeting apps can significantly improve financial literacy and discipline by providing insights into spending patterns and automating the savings process.

The impact can be substantial. The average Australian saves approximately $720 per month, with residents in NSW and the ACT emerging as the biggest savers, putting away $813 and $895 per month, respectively. For those looking to join these successful savers, the right budgeting app, whether free or paid, could make all the difference in 2025.

Frollo

Frollo stands out as an Australian-made budgeting app that helps users take control of their finances through comprehensive tracking and thoughtful insights. This powerful money management tool connects with over 100 financial institutions to provide users with a comprehensive view of their financial health.

Frollo Key Features

Frollo offers a robust set of features designed to simplify financial management:

- Real-time financial overview – The app provides a central hub that brings together all financial accounts in one place, including bank accounts, investment portfolios, superannuation, overseas currencies, and even loyalty points.

- Automatic spend categorisation – Transactions are automatically sorted into categories, making it easier to track spending patterns.

- Budgeting and bill tracking – The app helps users create customised budgets and includes bill tracking features that send alerts before payments are due.

- Goal setting and challenges – Users can set specific savings goals and take on challenges (such as reducing food deliveries) with in-app prompts and notifications to help them achieve their goals.

- Smart money insights – The app provides personalised financial insights and nudges to improve money habits.

- Financial health score – A unique “Frollo score” feature rates users’ financial health on a scale of 1 to 1,000, encouraging positive financial behaviours.

The impact of these features is substantial. On average, Frollo users reduce their credit card debt by AUD 703.34 and increase their savings by AUD 1,681.89 within the first six months of use. Furthermore, research by Frollo found that Australians using money management apps save an average of AUD 504.57 per month, with account balances increasing by 13% and savings growing by 21% after just three months.

Frollo Pricing

One of the most appealing aspects of Frollo is its cost structure – the app is entirely free to use. Unlike many competitors that offer limited free versions with premium paid tiers, Frollo provides complete access to all features without subscription fees.

How does Frollo remain free? The company generates revenue by building white-label applications for other companies using its free app technology. This business model allows them to offer a comprehensive budgeting solution at no cost to users while still maintaining a sustainable business.

WeMoney

WeMoney has positioned itself as Australia’s leading social financial wellness app, with an impressive track record of helping users manage finances and reduce debt. Downloaded by over 1,350,000 Australians, this comprehensive budgeting app combines expense tracking, debt management, and community support in a single platform.

WeMoney Key Features

WeMoney offers a robust suite of tools designed to simplify financial management:

- All-in-one financial dashboard – Users can connect all their financial accounts in one place, including savings and transaction accounts, credit cards, buy now pay later services, home loans, personal loans, share trading accounts, and superannuation funds.

- Debt management tools – The app specialises in helping users visualise and manage debt, breaking it down into manageable steps and offering personalised debt consolidation solutions.

- Credit Score Monitoring – WeMoney partners with Equifax and Experian to provide free credit score updates and monitoring. The average member improves their credit score by 63 points after nine months of using the app.

- Budgeting capabilities – The app automatically categorises transactions, tracks spending patterns, and allows users to set up different budgets by category with notifications when approaching limits.

- Financial community – A unique social element enables users to connect with others, join finance-related groups, and share tips for improving financial habits.

- Bill and subscription tracking – The app identifies recurring expenses and sends reminders before payments are due, helping users avoid late fees.

WeMoney’s impact is substantial—92.3% of members report an improved financial life since joining, with many users successfully consolidating debts and lowering their interest rates.

WeMoney Pricing

WeMoney operates on a freemium model, offering both free and premium options:

The free version provides access to core features, including account connections, spending tracking, basic budgeting tools, monthly credit score updates, goal setting, and community access.

For enhanced functionality, WeMoney Pro costs AUD 15.27 per month (billed monthly) or can be purchased annually at a discounted rate. Pro features include:

- Unlimited custom spending categories

- Desktop accounts and transactions view

- Equifax credit fraud detection with daily alerts

- Automatic goal tracking through linked accounts

- Ad-free experience

- Projected net worth tracking (coming in 2025)

- Early access to new features

New users can try WeMoney Pro for free for 7 days before committing to a subscription, which can be cancelled at any time. Additionally, RAC members receive a 20% exclusive discount on premium memberships.

Goodbudget

Based on the traditional envelope method, Goodbudget offers a digital twist to budgeting that encourages mindful spending through a visual representation of funds. This app stands apart from its competitors by focusing on manual tracking rather than automatic bank connections, making it suitable for users who prefer a hands-on approach to financial management.

Goodbudget Key Features

Goodbudget transforms the classic envelope budgeting system into a digital experience with several helpful tools:

- Envelope budgeting system – Users allocate income into various virtual envelopes for different spending categories like rent, groceries, and entertainment, helping to visualise budget allocations

- Manual transaction tracking – Unlike other budgeting apps, Goodbudget requires users to enter transactions, fostering greater awareness of spending habits manually

- Spending analysis – The app provides reports, including income versus spending comparisons and pie-charts that break down expenditures by envelope

- Budget sharing – Users can sync their budget across devices and share with partners, ensuring everyone stays on the same page financially

- Debt tracking – A dedicated web feature allows users to monitor debt payoff progress and visualise when they’ll be debt-free

- Scheduled transactions – Users can set up recurring transactions and receive email notifications for upcoming expenses

Fundamentally, what makes Goodbudget stand out is its emphasis on planning spending rather than merely tracking it, encouraging users to think ahead about financial decisions.

Goodbudget Pricing

Goodbudget follows a freemium model with two distinct tiers:

Free Version:

- 10 regular envelopes and 10 additional envelopes

- Single account connection

- Sync across two devices

- 1 year of transaction history

- Community support through forums

Premium Version:

- Costs AUD 15.29 per month or AUD 122.32 annually

- Unlimited regular and additional envelopes

- Unlimited accounts

- Sync across five devices

- 7 years of transaction history

- Email support

Essentially, the free version provides sufficient functionality for users with simple financial needs, whereas the premium subscription caters to those requiring more detailed budget management.

YNAB (You Need A Budget)

YNAB (You Need A Budget) follows a distinct philosophy that sets it apart from other financial tools. Founded on four key principles, this budgeting app encourages users to assign every dollar a purpose, acknowledge true expenses, roll with the punches, and invest their money wisely.

YNAB Key Features

YNAB offers a robust set of tools designed around its zero-based budgeting approach:

- Proactive budgeting – Unlike reactive tracking, YNAB focuses on planning with money already in hand, not anticipated future income.

- Goal tracking – Users can set and monitor targets for everything from vacation savings to debt reduction, with visual progress indicators

- Loan calculator – The integrated loan planner calculates interest and time savings for every extra dollar applied toward debt

- Spending reports – Detailed graphs and charts visualise spending patterns and net worth growth, making financial progress visually engaging.

- Account sharing – YNAB allows sharing subscriptions with up to six people (partners or family members) under a single subscription cost.

- Adaptable system – If users overspend in one category, YNAB permits fund reallocation from other categories to maintain overall budget integrity

On average, new YNAB users save AUD 917.39 in their first two months and over AUD 9173.94 after one year of consistent use. Furthermore, 92% of users report experiencing less financial stress since adopting the system.

YNAB Pricing

YNAB operates on a subscription model with straightforward pricing options:

YNAB costs AUD 22.92 per month or AUD 151.37 per year, with prices for new signups increasing to AUD 166.66 annually from August 2024. All new users receive a 34-day free trial—slightly longer than a standard month to give users time to experience a full budget cycle.

For eligible students, YNAB offers a 365-day free trial through their College Programme upon submission of valid proof of enrollment. No credit card is required when signing up directly through YNAB’s website, consequently making the trial truly risk-free.

Buddy

Originally from Sweden, Buddy offers a distinctive approach to financial management by enabling users to create and share budgets with partners or loved ones. This stylish app provides both manual transaction tracking and bank synchronisation options, making it flexible for different budgeting preferences.

Buddy Key Features

The app delivers several practical tools for effective budget management:

- Bank account synchronisation – Users can import transactions from Australian bank accounts to track budget progress automatically

- Split expense function – This feature clarifies who paid what and how to settle shared bills, making it perfect for household or travel expenses

- Customisable interface – The app allows users to create their own spending categories and select colour themes to personalise their experience

- Net worth tracking – Buddy supports setting up multiple accounts, as well as any debts, to provide a comprehensive view of total net worth.

- Detailed financial overview – The interface presents thorough yet straightforward insights into spending patterns, income, and savings

For those concerned about privacy, Buddy stands out from many competitors as it offers the option to manually add transactions without requiring a connection to bank accounts.

Buddy Pricing

Buddy operates on a freemium model with straightforward pricing options:

The app is free to download, offering basic functionality for users who want to test its features. Nevertheless, accessing the complete range of tools requires a premium subscription.

Current pricing for Buddy Premium varies across sources, with the most recent data indicating costs of AUD 15.27 per month or AUD 76.43 per year. An alternative source lists a more affordable rate of AUD 7.63 per month or AUD 53.50 per year. Given this discrepancy, prospective users should check current pricing on the official app page.

The subscription enables users to access all premium features, including unlimited categories and enhanced tracking capabilities.

Gather

Gather takes wealth management beyond simple budgeting, offering Australians a comprehensive view of their financial landscape through a sleek, intuitive interface. This app helps users build wealth without relying on complicated spreadsheets, instead providing real-time tracking and insights.

Gather Key Features

Gather combines several powerful tools to give users complete financial visibility:

- Real-time account syncing – Connect with 100+ Australian banks via Open Banking for automatic transaction updates

- Property equity monitoring – Add homes or investment properties and link loans to track equity growth over time

- Portfolio tracking – Import stocks and cryptocurrency holdings via screenshots, with prices updating during market hours

- Bill prediction – View upcoming bills, regular payments and subscriptions on a clear timeline

- Tax assistance – Find potential tax deductions through a smart search of bank statements

- Activity analysis – Detect fraud, spot hidden charges and track changes to bills across all accounts in a unified feed

The impact of these features is noteworthy—78% of users report feeling less anxious about money after switching to Gather, meanwhile 70% say it helps them feel more confident making financial decisions.

Gather Pricing

Gather employs a straightforward subscription model:

Gather costs AUD 22.92 per month or AUD 15.27 per month when billed annually (saving AUD 91.74 per year). Initially, all users receive a 5-week free trial with no credit card required.

Beem

Developed by central Australian banks, Beem offers instant payment capabilities alongside budgeting features, creating a seamless experience for managing money. Formerly known as Beem It, this digital wallet has evolved beyond simple payments to include financial tracking tools and features.

Beem Key Features

Beem combines several practical financial tools that simplify money management:

- Instant payments – Send and receive money within seconds between users, regardless of which Australian bank they use

- Bill splitting – Track shared expenses and automatically send payment reminders to friends, removing the awkwardness of chasing money

- Cashback rewards – Earn rewards when shopping with partner retailers, with accumulated “Beembucks” cashable to your debit card

- Digital wallet – Store payment cards and loyalty cards digitally, maximising points when you pay

- Cross-account transfers – Move funds between your accounts at different banks with instant access

Beem Pricing

Beem offers multiple subscription tiers to match different financial needs:

The app is free to download, offering basic functionality. For premium features, Beem provides several subscription options:

- Lite: AUD 1.51 monthly or AUD 15.27 yearly

- Basic: AUD 3.78 monthly or AUD 38.21 yearly

- Plus: AUD 9.13 monthly or AUD 76.43 yearly

- Pro: AUD 19.83 monthly or AUD 152.88 yearly

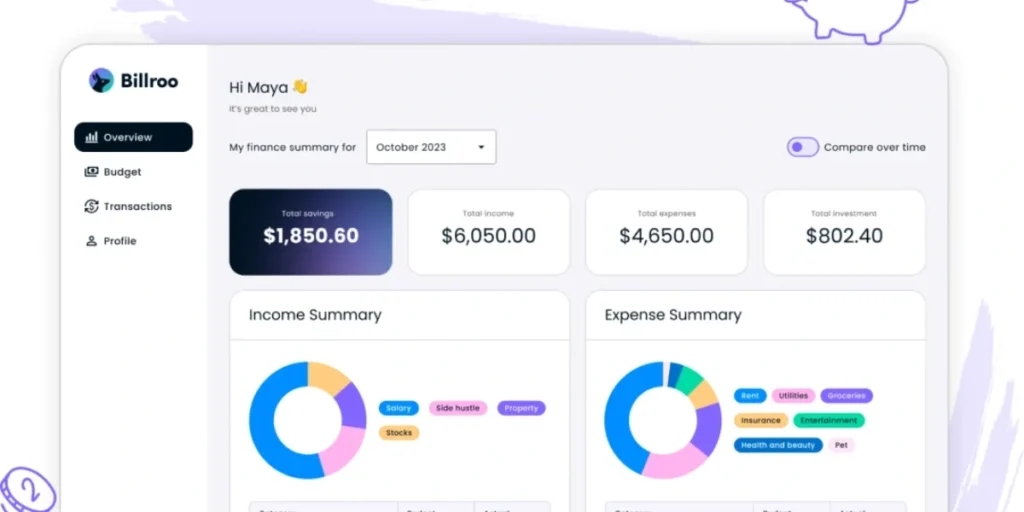

Billroo

Created by financial experts, Billroo is an AI-powered budgeting app designed specifically for Australians seeking to gain control over their finances and achieve their financial goals.

Billroo Key Features

Billroo offers several intelligent tools to simplify money management:

- AI-powered insights – Ask questions about your budget and receive personalised analysis of spending patterns and trends

- Auto-categorisation – Transactions are automatically sorted yet remain customisable for greater control

- Open Banking integration – Securely connect Australian bank accounts without sharing passwords

- Custom budget categories – Create personalised categories and spending limits to match specific goals

- Tax expense reporting – Identify potential tax deductions throughout the year

Billroo Pricing

Billroo operates on a straightforward subscription model:

The app offers a 14-day free trial with complete access to all features. Following this trial period, users can choose between:

- Monthly subscription: AUD 12.22

- Annual subscription: AUD 114.66 (saving approximately AUD 31.98 yearly)

Conclusion – Top Budgeting Apps

Finding the right budgeting app certainly makes a significant difference when trying to save money. As highlighted throughout this review, Australians now have access to numerous quality options tailored to different financial situations and preferences.

Choosing between these top budgeting apps ultimately depends on your specific needs and preferences. Frollo stands out as a comprehensive free option with strong Open Banking integration, while WeMoney excels at debt management and building a financial community. Goodbudget appeals to those who prefer manual tracking through the envelope system, whereas YNAB offers a proven methodology, albeit without direct bank synchronisation in Australia.

Additionally, apps like Buddy provide excellent solutions for couples managing shared expenses, albeit currently limited to iOS users. Gather takes a broader approach by including property and investment tracking alongside everyday budgeting. Meanwhile, Beem combines payment capabilities with expense tracking, and Billroo leverages AI to deliver personalised financial insights specifically for Australians.

Regardless of which app you choose, the most critical factor remains consistency. Regular engagement with your chosen budgeting tool will likely yield the best results. Taking this first step toward financial organisation could help you join the ranks of successful Australian savers who put away hundreds of dollars monthly and build a more secure financial future.

What are the top budgeting apps available for Australians in 2025?

The top budgeting apps for Australians in 2025 include Frollo, WeMoney, Goodbudget, YNAB, Buddy, Gather, Beem, and Billroo. Each offers unique features to help users manage their finances and save money effectively.

How do these budgeting apps help Australians save more money?

These apps help Australians save more by offering features such as expense tracking, goal setting, debt management tools, and financial insights. Many users report significant improvements in their savings and overall financial health after consistently using these apps.

Are there free budgeting apps available for Australians?

Yes, several of the top budgeting apps offer free versions. For example, Frollo is completely free to use, while others, such as WeMoney and Goodbudget, offer free tiers with basic features. However, premium features often require a subscription.

Can these budgeting apps connect directly to Australian bank accounts?

Most of these apps, such as Frollo, WeMoney, and Gather, can connect directly to Australian bank accounts using Open Banking technology. However, some apps, such as YNAB, may require manual entry or third-party services for users in Australia.

Which budgeting app is best for couples managing shared finances?

Apps like Buddy and WeMoney are particularly well-suited for couples managing shared finances. They offer features for splitting expenses, shared budgeting, and transparency in joint financial management.